Maintaining a Permanent Account Number (PAN) is comparable to having a distinct identity for your financial activities in the world of banking and taxation. A PAN is a vital document that is important in many facets of your life, whether you are a person or a company the company. We’ll go into depth regarding a PAN in this post, including what it is, why it’s significant, how to apply for one, and how it affects your financial situation.

A Permanent Account Number (PAN) is a ten-digit alphanumeric number issued by the Income Tax Department of India to individuals and entities. It is a unique identification number that is used to track tax-related transactions in India.

A Permanent Account Number (PAN) is a ten-digit alphanumeric number issued by the Income Tax Department of India to individuals and entities. It is a unique identification number that is used to track tax-related transactions in India.

Table of Contents

What is a Permanent Account Number (PAN)?

A PAN’s first five characters are arranged in alphabetical while its last five are numerical. While the fourth character is a check number, the first three alphabetic characters are chosen at random. The taxpayer identity number (TIN), given by the Income Tax Department, consists of the last five numeric characters.

PAN is mandatory for a variety of financial transactions, including:

- Opening a bank account

- Investing in shares or mutual funds

- Buying a property

- Applying for a loan

- Filing income tax returns

The Significance of PAN in Financial Transactions

Anyone who does financial activities in India must have a PAN number. It aids in tracking tax-related tasks and is a safe and dependable means to identify individuals and businesses.

The following are some PAN-related financial transaction implications:

- PAN is a unique identification number: PANs are special identifying numbers that the Indian Income Tax Department issues to individuals and organizations. As a result, it is a trustworthy and tamper-proof method of identifying the people and organizations who engage in financial transactions.

- PAN helps to track tax-related transactions: In India, PAN is used to monitor transactions involving taxes. The government may use this to make sure everybody is paying their fair share of taxes.

- PAN is used to prevent fraud and money laundering: Fraud and laundering of cash may be stopped with PAN. This is due to the fact that it aids in confirming the legality of the people and organizations engaged in financial transactions.

- PAN is a requirement for certain financial transactions: For several financial transactions in India, a PAN is required. This involves opening a bank account, making stock or mutual fund investments, buying a home, requesting a loan, and submitting tax returns.

Legal Provisions and Regulations

| Legal Provision | Regulation |

|---|---|

| Income Tax Act, 1961 | Section 139A of the Income Tax Act, 1961, mandates that every person who is required to furnish an income tax return under the Act, must obtain a PAN. |

| PAN Card Rules, 2016 | The PAN Card Rules, 2016, prescribe the procedure for applying for and obtaining a PAN card. |

| Prevention of Money Laundering Act, 2002 | The Prevention of Money Laundering Act, 2002, requires that all financial institutions obtain PAN details of their customers before entering into any financial transaction with them. |

| Foreign Exchange Management Act, 1999 | The Foreign Exchange Management Act, 1999, requires that all individuals and entities who are dealing in foreign exchange must obtain a PAN card. |

| Know Your Customer (KYC) norms | The Reserve Bank of India (RBI) has prescribed KYC norms for all financial institutions. These norms require financial institutions to obtain PAN details of their customers as part of the KYC process. |

Documents Required for PAN Application

The following papers are needed to apply for an Indian PAN:

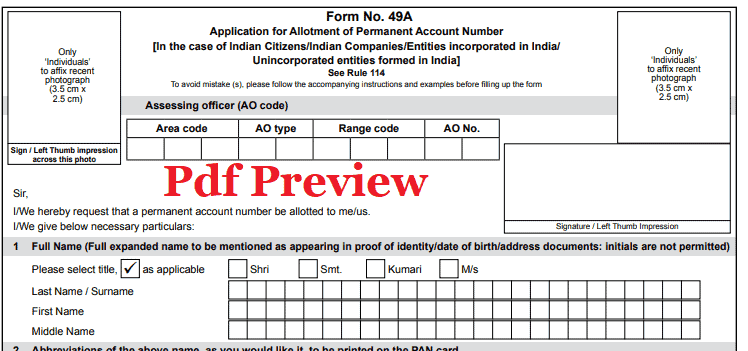

PAN application form: You can download the PAN application form online or from any PAN card issuing center.

Proof of identity: You can use any of the following documents as proof of identity:

PAN application form: You can download the PAN application form online or from any PAN card issuing center.

Proof of identity: You can use any of the following documents as proof of identity:

- Passport

- Voter ID card

- Driving license

- Aadhaar card

- PAN card

Proof of address: You can use any of the following documents as proof of address:

- Electricity bill

- Water bill

- Telephone bill

- Gas bill

- Bank statement

- Aadhaar card

Photograph: You need to submit a recent passport-size photograph of yourself.

PAN for Business Entities: Sole Proprietorships, Partnerships, and Companies

| Business Entity | PAN Requirements |

|---|---|

| Sole Proprietorship | The PAN of the proprietor will be used as the PAN of the sole proprietorship. |

| Partnership | The PAN of all the partners will be required to be submitted along with the PAN application form for the partnership. |

| Company | The PAN of the company will be obtained by the company secretary or authorized signatory of the company. |

Preventing Financial Frauds with PAN

| Preventive Measure | Description |

|---|---|

| Do not share your PAN with anyone unless it is absolutely necessary. | This includes online merchants, banks, and other financial institutions. If you are asked to provide your PAN, make sure that the website or organization is legitimate. You can verify the authenticity of a website by checking for the https:// security protocol and the presence of a valid privacy policy. |

| Keep your PAN details confidential. | Do not store your PAN in a file on your computer or in a cloud storage service. If you must store your PAN, encrypt it using a strong password. |

| Be wary of phishing emails and SMS messages. | Phishing emails and SMS messages often contain links that, when clicked, will take you to a fake website that looks like a legitimate financial institution. Once you enter your PAN on the fake website, the fraudsters will steal it. |

| Activate the OTP (One Time Password) feature for your PAN. | This feature will require you to enter a one-time password (OTP) every time you use your PAN for a financial transaction. This will help to prevent unauthorized access to your PAN. |

| Review your credit report regularly. | This will help you to identify any unauthorized activity on your credit report. If you see any suspicious activity, contact your credit card company or bank immediately. |

| Report any suspicious activity to the authorities. | If you believe that your PAN has been compromised, report it to the authorities immediately. You can file a complaint with the Cyber Crime Cell of the police or with the Income Tax Department. |

The Future of PAN: Evolving in the Digital Age

With the world moving towards digitization, PAN is also undergoing changes. E-PAN, a digitally signed PAN card, is gaining prominence, making the process even more efficient.

Conclusion

In the labyrinth of financial activities, a Permanent Account Number (PAN) acts as a guiding light. It ensures transparency, accountability, and compliance in various transactions. From individual taxpayers to business entities, PAN is a testament to the evolving landscape of financial regulations and digital empowerment.

FAQs

No, possessing multiple PANs is against the law and can lead to penalties.

PAN is not mandatory for minors, but it may be required for certain transactions involving them.

Yes, NRIs are eligible to apply for a PAN in India.

Related posts:

- AMC Full Form: Benefits, Components, Needs, Advantage

- ORS Full Form: Dehydration, Myths, Flavors, Varieties & Facts

- PCC Full Form: Importance, Types, Application Process

- BRB Full Form: Productive, Routine, Distractions

- MCD Full From: Introduction, Responsibility, Challenges

- CT Scan Full Form: Scans, price, Advantages

- USA Full Form: History, Economics,Technology, culture

- HCL Full Form: Factors, Signs, Assessment