This blog aims to delve deeper into the functionalities of NJ E Wealth Login, offering a step-by-step guide to its seamless registration process and elucidating the myriad benefits it brings to the table. By understanding the platform’s offerings and capabilities, users can harness the power of NJ E Wealth Login to take control of their finances and pave the way towards a brighter financial future.

- Overview Of NJ E Wealth Login

- Seamless Registration Process NJ E Wealth Login

- Navigating the Dashboard NJ E Wealth Login

- Investment Opportunities NJ E Wealth Login

- Customized Portfolio Management NJ E Wealth Login

- Real-Time Market Updates NJ E Wealth Login

- Secure Transactions NJ E Wealth Login

- Expert Financial Advice NJ E Wealth Login

- Frequently Asked Questions (FAQs)

Overview Of NJ E Wealth Login

| NJ E Wealth | Description |

|---|---|

| Platform Type | Financial Management Platform |

| Services Offered | Investment Planning, Portfolio Management, Market Analysis, Advisory Services |

| Registration Process | Simple and Hassle-Free |

| Dashboard | User-Friendly Interface with Easy Navigation |

| Investment Opportunities | Mutual Funds, Stocks, Bonds, SIPs |

| Portfolio Management | Customized to User’s Risk Tolerance and Financial Goals |

| Real-Time Market Updates | Stay Informed About Latest Trends and Developments |

| Official website | https://ewa.njindiaonline.com/ewa/login |

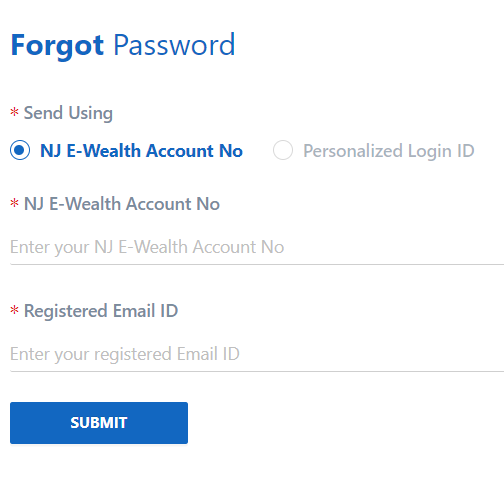

Seamless Registration Process NJ E Wealth Login

| Step | Action |

|---|---|

| 1. | Visit the NJ E Wealth Login website. |

| 2. | Click on the “Sign Up” or “Register” button. |

| 3. | Fill in the registration form with required details such as name, email address, and password. |

| 4. | Verify your email address by clicking on the confirmation link sent to your inbox. |

| 5. | Complete additional verification steps if prompted for added security. |

| 6. | Set up security measures such as PIN or security questions for account protection. |

| 7. | Review and agree to the terms and conditions of NJ E Wealth. |

| 8. | Click on the “Submit” or “Register” button to finalize the registration process. |

| 9. | Upon successful registration, you will be redirected to the NJ E Wealth Login dashboard. |

Navigating the Dashboard NJ E Wealth Login

Overview Section:

The dashboard usually features an overview phase that offers a picture of the consumer’s funding portfolio. Here, customers can speedy determine their portfolio’s overall performance, consisting of present day asset allocation, investment returns, and any recent transactions.

Navigation Menu:

A navigation menu is prominently displayed, offering clean get admission to to one-of-a-kind sections and features within the platform. Common menu gadgets include “Dashboard,” “Investments,” “Transactions,” “Reports,” and “Settings.”

Investment Summary:

Within the dashboard, users can view a precis of their investments, along with info which includes asset classes, investment kinds (e.G., mutual finances, shares), and contemporary market values. This precis affords users with a holistic view in their funding portfolio.

Performance Charts:

Interactive charts and graphs can be protected to visualize portfolio overall performance over the years. Users can customize these charts to display key metrics including returns, volatility, and asset allocation, taking into consideration higher analysis and decision-making.

Transaction History:

The dashboard usually consists of a phase devoted to displaying latest transactions. Users can review info of transactions, including date, type (e.G., purchase, sell), quantity, and transaction reputation.

Alerts and Notifications:

NJ E Wealth may also combine indicators and notifications immediately into the dashboard to maintain customers informed about vital updates, inclusive of account hobby, market fluctuations, or upcoming events associated with their investments.

News and Market Updates:

To keep users abreast of the latest market trends and developments, the dashboard may feature a news feed or market update section. Users can access relevant news articles, market analyses, and economic insights to stay informed about potential investment opportunities or risks.

Investment Opportunities NJ E Wealth Login

- Mutual Funds: NJ E Wealth gives get admission to to a extensive variety of mutual price range, allowing traders to diversify their portfolios across various asset classes and investment strategies.

- Stocks: Users can put money into person stocks indexed on predominant stock exchanges, permitting them to take benefit of capacity capital appreciation and dividend profits.

- Bonds: NJ E Wealth provides possibilities to spend money on bonds, inclusive of authorities bonds, corporate bonds, and municipal bonds, offering constant profits streams and doubtlessly decrease threat compared to stocks.

- Systematic Investment Plans (SIPs): Investors can choose SIPs, which allow for everyday investments in mutual funds at constant intervals, facilitating disciplined investing and rupee-fee averaging.

- Exchange-Traded Funds (ETFs): NJ E Wealth gives get entry to to ETFs, which might be funding funds traded on stock exchanges, imparting exposure to different portfolios of belongings such as stocks, bonds, or commodities.

- Portfolio Management Services (PMS): For investors searching for personalized funding techniques and expert management in their portfolios, NJ E Wealth offers Portfolio Management Services tailor-made to person threat profiles and financial dreams.

- Alternative Investments: Users may explore alternative funding options such as real estate investment trusts (REITs), gold, and commodity futures, diversifying their portfolios past traditional asset classes.

- Initial Public Offerings (IPOs): NJ E Wealth allows customers to take part in IPOs, supplying opportunities to spend money on newly indexed agencies and potentially capitalize on early-stage growth opportunities.

Customized Portfolio Management NJ E Wealth Login

Risk Assessment:

Before constructing a portfolio, NJ E Wealth assesses the user’s chance tolerance via a series of questions and analyses. This facilitates decide the appropriate asset allocation and investment strategies applicable to the person’s comfort level with market fluctuations and capacity losses.

Financial Goals Identification:

Users articulate their financial desires, whether it’s retirement planning, wealth accumulation, schooling funding, or another goal. NJ E Wealth factors in those goals to layout a portfolio strategy that targets to acquire the preferred consequences inside the precise timeframes.

Asset Allocation:

Based at the person’s hazard profile and financial desires, NJ E Wealth recommends an most desirable asset allocation method. This may additionally involve diversifying investments throughout asset lessons including equities, bonds, mutual funds, and opportunity investments to manipulate threat and decorate portfolio resilience.

Investment Selection:

NJ E Wealth provides get entry to to a extensive range of investment possibilities, which include mutual price range, stocks, bonds, ETFs, and greater. Users can pick out investments that align with their investment objectives, alternatives, and danger tolerance, with the power to modify their portfolio holdings as needed.

Regular Monitoring and Rebalancing:

NJ E Wealth constantly monitors the performance of users’ portfolios and periodically rebalances them to preserve the desired asset allocation and chance-go back profile. This proactive technique facilitates users stay on target towards their financial dreams and adapt to converting market conditions.

Tax Optimization:

NJ E Wealth incorporates tax-efficient investment strategies to minimize tax liabilities and maximize after-tax returns for users. This may include utilizing tax-saving investment options, harvesting capital losses, and optimizing asset location within taxable and tax-advantaged accounts.

Real-Time Market Updates NJ E Wealth Login

Live Market Data:

Users can get entry to stay market records, which includes real-time fees, indices, and buying and selling volumes for various asset lessons including shares, mutual budget, ETFs, and greater. This enables users to song the overall performance in their investments and make timely decisions based on cutting-edge marketplace situations.

Customizable Watchlists:

NJ E Wealth allows users to create customizable watchlists of their preferred securities or asset training. Users can add stocks, mutual finances, or ETFs to their watchlists and obtain actual-time updates on rate movements, news, and other applicable information for the securities they are monitoring.

Price Alerts:

Users can installation price alerts for precise securities to obtain notifications whilst prices reach predefined levels. This feature enables users to stay informed about fee movements and take movement consequently, such as shopping for or promoting securities at opportune moments.

News Feeds and Market Insights:

NJ E Wealth aggregates news articles, marketplace analyses, and professional insights from professional sources and delivers them immediately to customers via the platform. Users can live up to date on marketplace traits, monetary indicators, corporate announcements, and other applicable information which could impact their funding decisions.

Economic Calendar:

The platform includes an financial calendar highlighting key activities and monetary signs scheduled for release. Users can anticipate market volatility round important monetary activities consisting of GDP reports, interest fee selections, and employment records releases.

Market Commentary and Expert Analysis:

Users can access market commentary and expert analysis provided by NJ E Wealth’s team of financial professionals. These insights offer valuable perspectives on market trends, investment opportunities, and potential risks, helping users navigate volatile market conditions with confidence.

Secure Transactions NJ E Wealth Login

Encryption Protocols:

NJ E Wealth employs superior encryption protocols to steady users’ information for the duration of transmission. This encryption generation guarantees that touchy facts, such as login credentials, private info, and monetary transactions, is encrypted and guarded from unauthorized get admission to.

Secure Socket Layer (SSL) Technology:

The platform makes use of SSL era to establish a stable and encrypted connection between users’ internet browsers and NJ E Wealth’s servers. This enables prevent interception of facts at some stage in transmission and protects in opposition to guy-in-the-middle attacks.

Two-Factor Authentication (2FA):

NJ E Wealth offers two-element authentication as an additional layer of security for user bills. Users can choose to permit 2FA, requiring them to provide a secondary authentication aspect, along with a one-time password sent to their cellular tool, in addition to their login credentials.

Secure Payment Gateways:

For economic transactions which includes deposits, withdrawals, and investments, NJ E Wealth companions with legit price gateways and financial establishments that adhere to industry-preferred safety protocols. This guarantees that users’ fee statistics is treated securely and compliantly.

Transaction Monitoring and Fraud Detection:

NJ E Wealth employs sophisticated monitoring structures to detect and prevent fraudulent transactions in actual-time. Automated fraud detection algorithms analyze transaction patterns, discover suspicious activity, and cause signals for similarly research by means of security groups.

Regular Security Audits and Assessments:

NJ E Wealth conducts regular security audits, assessments, and penetration testing to identify and address potential vulnerabilities in its systems and infrastructure. This proactive approach helps strengthen security measures and mitigate risks associated with cyber threats.

Expert Financial Advice NJ E Wealth Login

Professional Guidance: NJ E Wealth gives customers with get entry to to professional economic advisors who offer expert guidance and insights tailor-made to person financial goals and circumstances.

Personalized Recommendations: Financial advisors on NJ E Wealth offer personalized recommendations primarily based on users’ risk tolerance, investment goals, and time horizon, assisting them make informed choices aligned with their monetary aspirations.

Portfolio Review and Analysis: Users can request portfolio opinions and evaluation from financial advisors, who check the overall performance, asset allocation, and hazard-go back profile in their investment portfolios. This facilitates customers identify regions for improvement and optimize their investment strategies.

Investment Planning: NJ E Wealth’s economic advisors assist customers in developing complete funding plans tailor-made to their unique wishes and targets. This might also consist of retirement planning, wealth accumulation, education funding, tax optimization, and extra.

Market Insights and Trends: Financial advisors offer users with valuable insights into market traits, financial signs, and investment opportunities. They provide views on market dynamics, sector analysis, and asset allocation strategies to help users navigate changing marketplace situations.

Risk Management Strategies: NJ E Wealth’s monetary advisors help users check and manage investment risks efficiently. They teach users approximately chance mitigation strategies, diversification strategies, and asset allocation ideas to shield their funding portfolios.

Tax-Efficient Investing: Financial advisors on NJ E Wealth provide steering on tax-green investing techniques to reduce tax liabilities and maximize after-tax returns. They endorse users on tax-saving funding alternatives, capital profits control, and retirement making plans strategies.

Regular Monitoring and Support: NJ E Wealth’s financial advisors offer ongoing aid and monitoring of customers’ investment portfolios. They conduct periodic evaluations, verify overall performance, and make changes as had to maintain customers on track in the direction of their monetary goals.

Frequently Asked Questions (FAQs)

NJ E Wealth Login is a comprehensive financial management platform that offers a range of services including investment planning, portfolio management, market analysis, and expert financial advice.

To register for NJ E Wealth Login, simply visit the platform’s website and click on the “Sign Up” or “Register” button. Follow the prompts to create an account by providing necessary details such as name, email address, and password.

NJ E Wealth Login provides access to various investment options including mutual funds, stocks, bonds, ETFs, SIPs, PMS, IPOs, FDs, NPS, and alternative investments.

Yes, NJ E Wealth Login prioritizes the security of users’ financial data and transactions. The platform employs advanced encryption protocols, secure payment gateways, and two-factor authentication to safeguard user information.

Users can access real-time market updates on NJ E Wealth Login through the platform’s dashboard, which provides live market data, customizable watchlists, price alerts, news feeds, economic calendars, and expert analysis.

Related posts:

- Jaa Lifestyle Login: Portal, Benefits, Product and Services

- Spice Money Login: Guide, Seamless Experience, App Login

- Hotstar Login: Creating Account, Troubleshooting, Premium vs Free

- Staff Login: Right Authentication, Challenges, SSO, Training

- AWPL Login: Features, Authentication Methods, Troubleshooting

- IFHRMS Login: Organizations, Security, Troubleshooting

- SSO ID Login: Process, Update, Security, Navigating

- Epunjabschool Login: Academic Progress, Registration Process