In this comprehensive guide, we embark on a journey to uncover the transformative potential of PayNearby Login. From understanding its core functionalities to exploring its myriad benefits, we delve deep into how this platform simplifies financial transactions and enhances the overall banking experience.

- Step-by-Step Guide to PayNearby Login

- Why Choose PayNearby Login? Exploring its Benefits

- Enhancing Accessibility: PayNearby Login Across Platforms

- Securing Your Transactions with PayNearby Login

- Exploring PayNearby Login Services: From Bill Payments

- PayNearby Login: Empowering Local Businesses and Entrepreneurs

- Customer Support Excellence: Navigating Issues with PayNearby Login

- The Future of FinTech: PayNearby’s Role in Digital Transformation

- Frequently Asked Questions (FAQs)

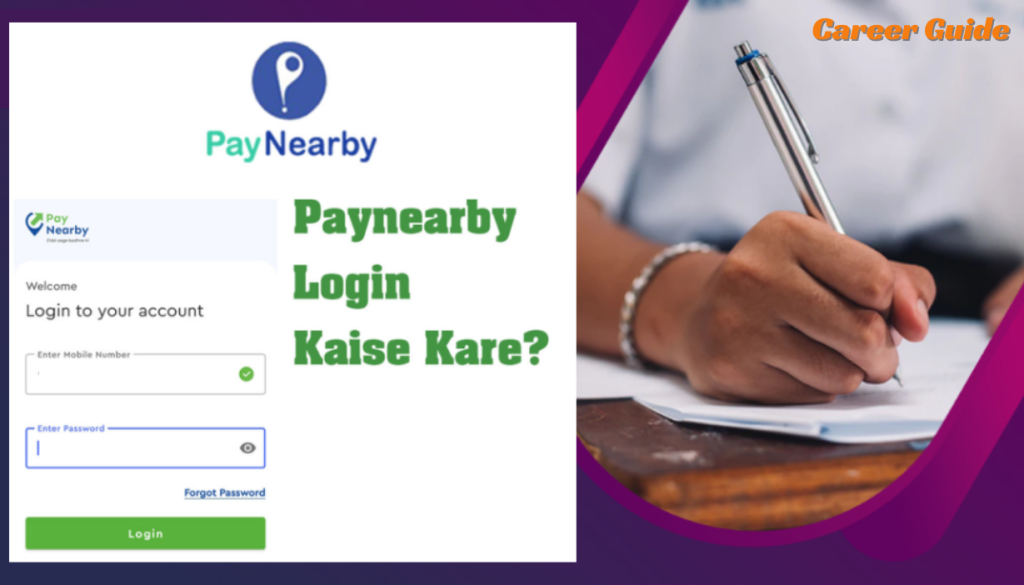

Step-by-Step Guide to PayNearby Login

Navigating the PayNearby login method is simple and easy, permitting users to gain get entry to to a wealth of monetary offerings with no trouble. Whether you’re a primary-time consumer or a seasoned veteran, this step-by using-step guide will stroll you through the manner, ensuring a seamless login experience.

1: Download the PayNearby App

Begin by using downloading the PayNearby app from the Google Play Store or Apple App Store, relying for your tool’s running gadget. Alternatively, you can go to the PayNearby website to get right of entry to the internet-based platform.

2: Account Registration

Upon launching the app or getting access to the website, you will be caused to check in for a PayNearby account. Enter your details as it should be, along with your name, cellular wide variety, e mail cope with, and another required records.

3: Verification

After supplying your details, PayNearby may require verification to make sure the safety of your account. This may also contain receiving an OTP (One-Time Password) through SMS or e-mail, which you may want to go into to proceed with the registration manner.

4: Set Password

Once your account is proven, you’ll be caused to set a password to your PayNearby account. Choose a robust and memorable password to make certain the security of your account.

5: Login

With your account effectively registered and password set, you’re now ready to log in to PayNearby. Enter your registered mobile variety or e mail cope with along with the password you’ve got set throughout registration.

6: Two-Factor Authentication (Optional)

For added security, PayNearby can also provide two-issue authentication (2FA) as an non-obligatory function. If enabled, you could want to verify your identity through an additional approach, such as an OTP despatched on your registered cell variety or electronic mail.

7: Access Financial Services

Once logged in, you will benefit get entry to to a huge variety of economic services offered through PayNearby. Whether you’re trying to make bill payments, switch cash, or avail yourself of other banking offerings, you could without difficulty navigate thru the app or internet site to get right of entry to the preferred features.

8: Explore Additional Features

Beyond fundamental economic transactions, PayNearby can also offer additional functions and services tailored in your desires. Take some time to discover the numerous offerings to be had inside the platform and discover how PayNearby can similarly streamline your economic control responsibilities.

9: Logout (Optional)

After finishing your transactions or when you’re performed the usage of the PayNearby platform, it’s crucial to log off of your account to make sure the safety of your personal and economic statistics. Look for the logout alternative in the app or internet site and observe the activates to soundly exit your session.

10: Keep Your Credentials Secure

Lastly, usually prioritize the safety of your PayNearby login credentials. Avoid sharing your password or private records with anyone and regularly update your password to mitigate the risk of unauthorized access to your account.

Why Choose PayNearby Login? Exploring its Benefits

PayNearby login offers a plethora of blessings that cater to the various desires of individuals and organizations alike. Let’s delve into some of the compelling motives why you ought to select PayNearby on your financial transactions.

1. Convenience at Your Fingertips:

With PayNearby, long past are the days of long queues and tedious paperwork associated with conventional banking techniques. Whether you want to pay payments, switch money, or recharge your mobile telephone, PayNearby puts most of these services right at your fingertips. Its intuitive interface and seamless person revel in ensure that coping with your budget is brief, easy, and problem-free.

2. Accessibility Across Platforms:

PayNearby acknowledges the significance of accessibility in present day digital age. Whether you opt to get right of entry to financial services to your cellphone, tablet, or pc, PayNearby offers a move-platform enjoy that permits you to manipulate your price range each time, everywhere. This versatility guarantees that you’re never a ways from your cash, no matter what device you are the usage of.

3. Wide Range of Services:

One of the key advantages of selecting PayNearby is the various array of economic services it gives. From utility invoice bills to coverage charges, from mobile recharges to loan programs, PayNearby covers a extensive spectrum of economic wishes below one roof. This comprehensive suite of services removes the need to juggle more than one platforms or visit various provider providers, streamlining your economic transactions within the method.

4. Speed and Efficiency:

In cutting-edge fast-paced global, time is of the essence. PayNearby recognizes this need for velocity and efficiency, ensuring that your financial transactions are processed quickly and securely. Whether you are making a price or transferring finances, PayNearby’s strong infrastructure and modern-day era permit rapid and dependable transactions, permitting you to get again to what subjects most straight away.

5. Enhanced Security Measures:

Security is paramount in terms of economic transactions, and PayNearby takes this component significantly. Utilizing brand new encryption protocols and multi-layered security features, PayNearby ensures that your private and economic data remains safe and stable always. With PayNearby, you can have peace of mind understanding that your sensitive records is blanketed from unauthorized access and cyber threats.

6. Empowering Local Businesses:

Beyond its benefits to people, PayNearby also plays a critical position in empowering local companies and entrepreneurs. By supplying them with get entry to to virtual financial services, PayNearby helps stage the playing subject and force financial inclusion in underserved groups. Whether it’s a small retail keep or a community convenience keep, PayNearby allows these agencies to offer essential economic services to their clients, thereby fostering financial increase and prosperity at the grassroots stage.

Enhancing Accessibility: PayNearby Login Across Platforms

1. Mobile Accessibility:

For customers who decide upon the ease of dealing with their finances on the go, PayNearby offers a sturdy cell app available for both Android and iOS gadgets. Whether you are the usage of a cellphone or tablet, you may simply download the PayNearby app from the Google Play Store or Apple App Store and log in together with your credentials. The mobile app provides all of the functions and functionalities of the PayNearby platform in a person-pleasant interface optimized for smaller monitors, permitting you to get entry to financial services anytime, anywhere.

2. Web Accessibility:

For those who opt to get admission to monetary services from their computing device or pc computers, PayNearby gives a web-primarily based platform reachable thru any widespread web browser. Simply visit the PayNearby website and log in using your credentials to get admission to a extensive variety of financial offerings. The web-primarily based platform gives the equal stage of capability because the mobile app, making sure a steady user enjoy throughout extraordinary gadgets and running structures.

3. Cross-Platform Synchronization:

One of the key blessings of the usage of PayNearby is its seamless synchronization across a couple of structures. Whether you provoke a transaction on the cellular app or the net-primarily based platform, your account records and transaction records stay synchronized in real-time, ensuring that you can choose up wherein you left off no matter the tool you are the use of. This cross-platform synchronization complements convenience and versatility, permitting you to control your finances seamlessly throughout specific devices.

4. Responsive Design:

PayNearby’s cell app and internet-primarily based platform feature responsive layout, which means that that the interface automatically adapts to the display size and backbone of the tool being used. Whether you’re the usage of a telephone, tablet, or laptop, the PayNearby interface adjusts dynamically to offer an surest viewing and interaction experience, minimizing the need for horizontal scrolling or zooming. This responsive design enhances usability and accessibility, ensuring a regular user enjoy across all gadgets.

5. Accessibility Features:

In addition to its cross-platform compatibility, PayNearby also incorporates accessibility functions to cater to customers with numerous desires and preferences. These capabilities may consist of customizable font sizes, high evaluation modes, and guide for display screen readers, making the platform on hand to individuals with visible or auditory impairments. By prioritizing accessibility, PayNearby ensures that its offerings are available to everybody, no matter their competencies or barriers.

Securing Your Transactions with PayNearby Login

1. Encryption Protocols:

PayNearby employs superior encryption protocols to encrypt facts transmitted among your tool and its servers. This guarantees that your non-public and monetary statistics stays secure all through transit, making it definitely impossible for unauthorized parties to intercept and decipher the data.

2. Secure Login Process:

The PayNearby login procedure is designed with protection in mind. Users are required to authenticate themselves using a mixture of credentials, which include a username or registered cell wide variety, and a password. Additionally, PayNearby can also offer -element authentication (2FA) as an optional safety degree, requiring users to confirm their identification thru a secondary approach, which include an OTP (One-Time Password) despatched to their registered cell variety or electronic mail cope with.

3. Multi-Layered Authentication:

In addition to standard login credentials, PayNearby may rent multi-layered authentication mechanisms to similarly decorate protection. This may consist of biometric authentication techniques along with fingerprint or facial recognition, which add an additional layer of safety towards unauthorized get right of entry to for your account.

4. Device Authorization:

PayNearby permits customers to authorize unique devices for gaining access to their money owed. This manner that although a person gains get entry to for your login credentials, they may not be capable of log in from an unauthorized device with out your express approval. This facilitates prevent unauthorized get right of entry to in your account, even inside the event of credential compromise.

5. Regular Security Audits:

PayNearby conducts regular safety audits and exams to pick out and address ability vulnerabilities in its systems and infrastructure. By staying vigilant and proactive, PayNearby ensures that its security features continue to be strong and effective towards emerging threats and attack vectors.

6. Fraud Monitoring and Detection:

PayNearby employs state-of-the-art fraud monitoring and detection structures to discover suspicious sports and flag potentially fraudulent transactions in real-time. This allows PayNearby to take immediate movement to mitigate dangers and protect customers from economic losses because of fraudulent activities.

Exploring PayNearby Login Services: From Bill Payments

Let’s delve into how PayNearby login services facilitate seamless bill bills, empowering customers to live on pinnacle in their economic responsibilities quite simply.

1. Utility Bill Payments:

PayNearby allows users to pay their software bills with no trouble from the comfort in their homes or on the move. Whether it’s strength, water, fuel, or different application payments, users can provoke payments at once via the PayNearby platform. By consolidating all application bills in one area, PayNearby streamlines the payment procedure and facilitates users keep away from missed deadlines and past due fees.

2. Mobile Recharges:

Gone are the days of speeding to the closest mobile recharge keep or scratching recharge cards to top up your telephone balance. With PayNearby, users can recharge their cellular phones instantly using their desired price approach. Whether you are on a pay as you go plan or want to pinnacle up your statistics stability, PayNearby ensures that your cellular telephone stays related always.

3. DTH Recharges:

In addition to cellular recharges, PayNearby also allows DTH (Direct-to-Home) recharges, allowing customers to resume their subscription to satellite television offerings problem-loose. Whether you are a fan of sports activities, movies, or amusement, PayNearby ensures uninterrupted get right of entry to in your favourite TV channels with only a few taps in your tool.

4. Broadband and Internet Bill Payments:

Say good-bye to lengthy queues at charge facilities and bulky on line banking tactics with regards to paying your broadband and net bills. PayNearby allows customers to settle their broadband and net bills quick and securely, ensuring uninterrupted access to high-speed net offerings for paintings, entertainment, and communique functions.

5. Insurance Premium Payments:

Managing insurance charges can be a bulky task, mainly whilst coping with multiple guidelines from unique carriers. With PayNearby, users can effortlessly pay their insurance premiums on-line, casting off the want for manual office work and bodily visits to coverage offices. Whether it is existence insurance, medical insurance, or vehicle insurance, PayNearby simplifies the premium price procedure, making sure that policyholders live covered at all times.

6. Loan EMI Payments:

For individuals with ongoing loan commitments, maintaining track of EMI (Equated Monthly Installment) bills is critical to maintaining a healthful credit profile. PayNearby permits customers to with ease pay their mortgage EMIs on-line, ensuring timely compensation and keeping off consequences or default notices from creditors. Whether it is a private mortgage, domestic mortgage, or automobile loan, PayNearby streamlines the EMI fee procedure, empowering customers to manage their debts efficiently.

PayNearby Login: Empowering Local Businesses and Entrepreneurs

Let’s discover how PayNearby login is remodeling the landscape for neighborhood companies and marketers, riding financial inclusion and monetary boom in communities across the country.

1. Access to Digital Financial Services:

One of the key ways wherein PayNearby empowers nearby businesses and marketers is by way of presenting them with access to a huge range of virtual monetary services. Through the PayNearby platform, small outlets and entrepreneurs can offer important banking offerings which include money transfers, invoice payments, and insurance merchandise to their clients. This no longer only complements the price proposition for their agencies however also positions them as one-forestall destinations for monetary offerings of their communities.

2. Increased Footfall and Revenue:

By diversifying their services to consist of virtual economic services, nearby agencies and entrepreneurs appeal to a broader customer base and increase footfall to their establishments. Customers who go to these outlets for financial transactions are possibly to make additional purchases, thereby boosting sales for the organizations. This symbiotic dating between financial offerings and traditional retail offerings fosters economic growth and sustainability at the neighborhood degree.

3. Empowerment Through Technology:

PayNearby leverages technology to democratize get admission to to financial services, empowering local corporations and entrepreneurs to compete on a degree playing field with larger establishments. Through the PayNearby platform, these groups can leverage the equal generation and infrastructure utilized by hooked up economic institutions, allowing them to deliver seamless and efficient offerings to their customers.

4. Revenue Generation and Commission:

For neighborhood corporations and marketers who companion with PayNearby, presenting digital monetary offerings will become a supply of additional sales generation. PayNearby provides attractive commissions and incentives for transactions carried out through its platform, permitting groups to earn sales on each transaction processed. This creates a sustainable sales flow for these businesses while concurrently using financial inclusion in underserved groups.

5. Financial Inclusion and Empowerment:

Perhaps the maximum enormous impact of PayNearby login for nearby businesses and entrepreneurs is its contribution to economic inclusion and empowerment. By supplying get entry to to virtual monetary services in far flung and underserved regions, PayNearby enables those who had been formerly excluded from the formal banking area to participate in the digital economy. This now not only enhances their economic potentialities however additionally fosters social inclusion and empowerment within their communities.

Customer Support Excellence: Navigating Issues with PayNearby Login

1. Dedicated Support Channels:

PayNearby offers more than one channels through which customers can are seeking for help with their login or some other queries they’ll have. These channels may include a committed customer support hotline, e mail guide, live chat, and social media channels. By offering diverse avenues for communique, PayNearby guarantees that customers can attain out for help through their favored method of touch.

2. Prompt Response Times:

One of the hallmarks of PayNearby’s customer support excellence is its commitment to prompt response instances. Whether users attain out through smartphone, email, or stay chat, PayNearby strives to cope with their queries and worries in a timely manner. This guarantees that users receive the assistance they need without undue delay, minimizing any disruptions to their monetary transactions.

3. Knowledgeable Support Agents:

PayNearby’s customer support crew accommodates knowledgeable and experienced retailers who are properly-versed in the platform’s functionalities and troubleshooting procedures. Whether it’s a technical difficulty with the login process or a popular inquiry about using the platform, customers can rely on PayNearby’s aid marketers to provide correct and useful steering to clear up their troubles successfully.

4. Personalized Assistance:

PayNearby is familiar with that every consumer’s state of affairs is particular, that is why its customer service crew offers personalised assistance tailored to every user’s particular desires. Whether it is guiding a primary-time person thru the login method or troubleshooting a complicated technical issue, PayNearby’s guide dealers make an effort to understand the user’s worries and offer personalised answers for that reason.

5. Comprehensive FAQ and Knowledge Base:

In addition to direct assistance from help marketers, PayNearby provides customers with get admission to to a complete FAQ (Frequently Asked Questions) phase and knowledge base. This aid contains solutions to commonly encountered problems and step-by-step publications for resolving not unusual login and different platform-associated problems. By empowering users to locate answers to their questions independently, PayNearby enhances self-carrier aid alternatives and decreases reliance on direct help.

6. Continuous Improvement and Feedback Mechanisms:

PayNearby is devoted to constantly improving its customer service strategies based totally on consumer comments and evolving client wishes. The platform solicits comments from users concerning their assist experiences and makes use of this input to pick out regions for improvement and put in force changes to decorate patron satisfaction. This iterative approach guarantees that PayNearby’s customer service remains responsive and powerful in addressing users’ needs.

The Future of FinTech: PayNearby Login Role in Digital Transformation

1. Democratizing Access to Financial Services:

One of the maximum tremendous contributions of PayNearby login to the future of FinTech is its position in democratizing access to economic services. By imparting a consumer-friendly platform that allows individuals and businesses to get admission to a wide variety of banking and payment offerings, PayNearby is breaking down barriers and bringing monetary inclusion to underserved groups. Through its login platform, customers can seamlessly behavior transactions, transfer money, pay payments, and greater, no matter their vicinity or socioeconomic fame.

2. Driving Financial Inclusion:

Financial inclusion is a key pillar of the digital transformation adventure, and PayNearby is gambling a crucial position in riding this schedule ahead. Through its community of nearby outlets and entrepreneurs, PayNearby is increasing get admission to to banking and financial offerings in faraway and underserved areas wherein traditional banking infrastructure is limited. By leveraging its login platform, PayNearby is empowering folks that were formerly excluded from the formal banking quarter to take part inside the virtual financial system and access essential monetary services.

3. Accelerating Digital Payments Adoption:

As cashless transactions turn out to be more and more general in trendy digital age, the adoption of virtual payment solutions is important for riding monetary inclusion and financial growth. PayNearby login serves as a gateway to a huge range of virtual charge alternatives, together with cell wallets, UPI (Unified Payments Interface), and QR code payments. By making those fee techniques available via its platform, PayNearby is accelerating the shift towards a cashless economic system and permitting people and companies to embody digital payments for his or her financial transaction

4. Fostering Innovation and Collaboration:

PayNearby acknowledges that innovation and collaboration are vital drivers of digital transformation within the monetary enterprise. Through its login platform, PayNearby collaborates with financial institutions, technology partners, and government organizations to increase revolutionary answers that address the evolving needs of users. Whether it’s introducing new price techniques, launching revolutionary economic products, or implementing superior security functions, PayNearby is committed to driving innovation and fostering collaboration to form the future of FinTech.

5. Empowering Entrepreneurs and Local Businesses:

At the coronary heart of PayNearby’s digital transformation journey lies its dedication to empowering marketers and nearby companies. By supplying them with get admission to to digital financial services via its login platform, PayNearby is enabling those agencies to diversify their services, attract greater clients, and generate extra revenue streams. Whether it is a community convenience store or a small retail outlet, PayNearby empowers neighborhood corporations to grow to be monetary carrier providers of their communities, thereby riding monetary boom and prosperity on the grassroots degree.

Frequently Asked Questions (FAQs)

PayNearby is a main monetary generation business enterprise that offers a huge range of digital economic offerings thru its consumer-pleasant platform.

To get right of entry to PayNearby offerings, you could download the PayNearby app from the Google Play Store or Apple App Store, or visit the PayNearby website.

PayNearby gives a comprehensive suite of economic offerings, together with bill payments, cash transfers, cellular recharges, insurance merchandise, mortgage applications, and more.

Yes, PayNearby login is steady. The platform employs advanced encryption protocols, multi-component authentication, and different safety features to shield user records and transactions.

If you need to reset your PayNearby password, you could accomplish that by following the “Forgot Password” hyperlink at the login web page and following the prompts to reset your password securely.