In our comprehensive guide, we delve deep into the realm of ESIC Employer Login, offering insights, strategies, and best practices to empower employers in maximizing the benefits of this indispensable tool. From setting up your ESIC employer account to navigating its myriad features, managing employee data, and staying abreast of regulatory updates, we aim to equip you with the knowledge and resources needed to harness the full potential of ESIC for your organization.

- Setting Up Your ESIC Employer Login Account

- Importance of ESIC Employer Login

- Key Features and Functions ESIC Employer Login

- Streamlining Employee Data Management ESIC Employer Login

- Simplifying Contribution Payments ESIC Employer Login

- Leveraging ESIC Employer Login Welfare

- Staying Compliant: ESIC Employer Login Regulations and Updates

- Troubleshooting and Support Resources ESIC Employer Login

- Frequently Asked Questions (FAQs)

Setting Up Your ESIC Employer Login Account

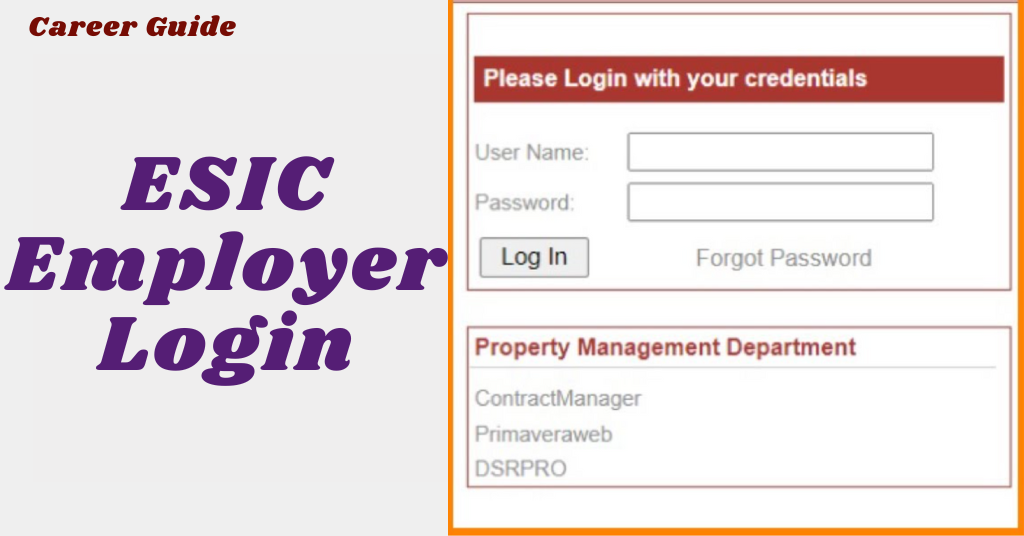

1: Accessing the ESIC Employer Login Portal

To initiate the setup method, get right of entry to the legit ESIC website (www.Esic.Nic.In) and find the ‘Employers’ phase. Within this section, you will discover the option to log in or check in as an company.

2: Registration

Click at the ‘Register’ or ‘Sign Up’ choice to begin the registration method. You’ll be precipitated to offer crucial information including your organisation’s registration number, PAN variety, and call facts.

3: Verification

After coming into the required details, the system will verify your records against the ESIC records. Ensure the accuracy of the facts furnished to expedite the verification procedure.

4: Account Activation

Once your statistics is correctly demonstrated, you’ll receive a confirmation e mail or SMS containing your login credentials and instructions for activating your account. Follow the supplied instructions to spark off your ESIC company account.

5: Logging In

Once your account is activated, return to the ESIC Employer portal and input your login credentials (username and password). Upon successful authentication, you may advantage get admission to to your employer dashboard.

6: Profile Setup

Upon logging in for the first time, you may be prompted to complete your business enterprise profile. Provide accurate details about your business enterprise, which include touch information, address, and authorized personnel.

7: Adding Employees

With your enterprise account installation, you can now continue to feature personnel on your ESIC roster. Navigate to the ‘Employee Management’ or ‘Add Employee’ phase within your dashboard and input the specified details for each employee, together with their private statistics and ESIC eligibility criteria.

8: Contribution Setup

Next, configure the contribution settings in your employees primarily based on the applicable salary threshold and contribution fees. Ensure compliance with ESIC policies concerning contribution calculation and fee timelines.

9: Familiarizing Yourself with Features

Take the time to discover the diverse functions and functionalities to be had in the ESIC Employer Login portal. Familiarize your self with options for managing worker data, processing contributions, producing reviews, and getting access to help assets.

10: Regular Maintenance and Updates

Maintaining your ESIC enterprise account involves ongoing management of employee records, contribution bills, and compliance obligations. Stay proactive in updating employee records, processing contributions, and adhering to regulatory updates to make sure seamless operations.

Importance of ESIC Employer Login

1. Centralized Management:

The ESIC Employer Login portal serves as a centralized platform for dealing with diverse aspects of employee welfare and statutory compliance. Employers can get entry to and update employee data, procedure contributions, publish claims, and music compliance requirements from a single interface, getting rid of the need for manual paperwork and disparate structures.

2. Real-Time Access to Information:

By offering real-time get admission to to vital records, the ESIC Employer empowers employers to make knowledgeable choices directly. Whether it is verifying worker eligibility, checking contribution fame, or accessing policy updates, employers can retrieve up-to-date statistics at their fingertips, fostering agility and responsiveness in workforce control.

3. Enhanced Efficiency:

Gone are the days of cumbersome administrative methods and manual document-retaining. The ESIC Employer Login streamlines administrative tasks, which includes worker data management, contribution processing, and declare submissions, via computerized workflows and intuitive interfaces. This efficiency interprets into time and fee savings for employers, letting them awareness on middle commercial enterprise sports.

4. Compliance Assurance:

Compliance with ESIC regulations is non-negotiable for employers, given its implications for worker welfare and prison duties. The ESIC Employer guarantees compliance through offering built-in assessments and validations, guiding employers via contribution calculations, submission cut-off dates, and regulatory updates. This proactive method minimizes the risk of penalties and legal repercussions related to non-compliance.

5. Seamless Employee Welfare Management:

At the heart of ESIC lies the welfare of protected employees, encompassing clinical benefits, economic help, and social security provisions. The ESIC Employer Login allows seamless control of worker welfare by means of enabling employers to enroll eligible employees, technique scientific claims, and facilitate get entry to to healthcare services efficiently. This contributes to worker pride and retention whilst pleasant employers’ social duty responsibilities.

6. Transparency and Accountability:

Transparency in worker welfare management is paramount for fostering believe and responsibility within companies. The ESIC Employer promotes transparency by using supplying clear visibility into contribution calculations, charge history, and compliance popularity. Employers can generate reviews, audit trails, and documentation effortlessly, making sure accountability of their interactions with personnel and regulatory authorities.

Key Features and Functions ESIC Employer Login

Let’s explore the key functionalities that make ESIC Employer Login quintessential for employers:

1. Employee Data Management:

Centralize and maintain comprehensive information of worker information, including private info, employment records, and ESIC eligibility standards. Employers can upload new employees, replace existing facts, and control employee facts successfully through intuitive interfaces.

2. Contribution Processing:

Facilitate seamless processing of ESIC contributions, which include worker deductions and organisation contributions. Employers can calculate contributions based totally on applicable salary thresholds, generate contribution statements, and provoke charge transactions securely within the portal.

3. Claim Submission and Processing:

Empower personnel to get admission to ESIC advantages via facilitating the submission and processing of medical claims, maternity benefits, and different entitlements. Employers can evaluate and approve claims submitted with the aid of employees, track declare popularity, and make certain well timed disbursement of blessings.

4. Compliance Monitoring:

Stay abreast of regulatory requirements and compliance responsibilities with built-in tracking gear and alerts. The ESIC Employer gives reminders for contribution deadlines, regulatory updates, and compliance tests, permitting employers to mitigate the risk of consequences and legal repercussions.

5. Reporting and Analytics:

Gain valuable insights into ESIC contributions, worker welfare usage, and compliance metrics through sturdy reporting and analytics competencies. Employers can generate custom reports, analyze tendencies, and pick out regions for improvement, facilitating knowledgeable choice-making and strategic making plans.

6. Document Management:

Organize and manipulate critical documents, inclusive of worker information, contribution statements, and compliance certificates, securely inside the portal. Employers can add, save, and retrieve files comfortably, making sure compliance with report-preserving requirements and facilitating audits.

7. Communication and Support:

Facilitate seamless conversation among employers, employees, and ESIC authorities via integrated messaging capabilities. Employers can are looking for help, clarify queries, and get right of entry to guide assets, fostering transparency and responsiveness of their interactions.

8. Multi-User Access and Permissions:

Collaborate effectively inside companies by assigning position-based get right of entry to and permissions to customers inside the ESIC Employer Login portal. Employers can outline user roles, control get right of entry to to touchy statistics, and preserve information protection even as promoting collaboration and responsibility.

Streamlining Employee Data Management ESIC Employer Login

1. Centralized Employee Database:

ESIC Employer Login serves as a centralized repository for storing complete worker statistics. Employers can access important data including private information, employment records, circle of relatives individuals, and ESIC eligibility criteria from a unmarried interface, eliminating the need for guide file-maintaining and disparate structures.

2. Efficient Onboarding Process:

Employers can streamline the onboarding procedure for brand spanking new employees by taking pictures essential statistics immediately via the ESIC Login portal. From non-public info to financial institution account facts and nominee info, employers can acquire all important facts correctly and correctly for the duration of the initial enrollment segment.

3. Real-time Updates:

Ensure the accuracy and forex of worker information thru real-time updates in the ESIC Employer Login portal. Employers can easily update employee details inclusive of address adjustments, marital fame, or structured records, ensuring that the ESIC database displays the maximum latest facts always.

4. ESIC Eligibility Verification:

Verify the eligibility of personnel for ESIC insurance seamlessly via the ESIC Employer portal. Employers can move-reference worker records with ESIC eligibility criteria, ensuring that only eligible personnel are enrolled within the scheme and get hold of the blessings they may be entitled to.

5. Contribution Management:

Efficiently manipulate ESIC contributions for protected employees based totally on their wage thresholds and contribution fees. The ESIC Employer Login portal calculates contributions appropriately, taking into consideration factors including worker wages, depart periods, and statutory changes, making sure compliance with contribution requirements.

6. Compliance Tracking:

Stay compliant with ESIC guidelines by monitoring employee facts and contributions effectively in the ESIC Employer portal. Employers can display contribution price closing dates, verify compliance with eligibility standards, and generate compliance reports to make certain adherence to regulatory requirements.

7. Secure Data Storage:

Ensure the safety and confidentiality of employee information via strong statistics encryption and get right of entry to controls inside the ESIC Employer Login portal. Employers can rest assured that touchy records is protected from unauthorized get entry to or misuse, maintaining believe and integrity in data management practices.

8. Integration with HR Systems:

Integrate ESIC Employer with existing HR structures or payroll software to streamline records trade and remove duplication of efforts. Employers can synchronize employee information seamlessly, making sure consistency across more than one systems and optimizing operational efficiency.

Simplifying Contribution Payments ESIC Employer Login

1. Automated Calculation:

ESIC Employer Login automates the calculation of contribution quantities based totally on applicable wage thresholds and contribution fees. Employers enter relevant worker facts, and the portal calculates contributions accurately, casting off guide errors and making sure compliance with statutory requirements.

2. Contribution Submission:

Employers can publish ESIC contributions directly through the ESIC Employer Login portal, streamlining the fee technique. The portal gives steady fee gateways for initiating transactions, making sure confidentiality and data integrity throughout the submission method.

3. Multiple Payment Options:

ESIC Employer gives flexibility in charge methods, allowing employers to select from various alternatives which includes on-line transfers, NEFT/RTGS, and e-charge portals. Employers can select the maximum convenient price method primarily based on their possibilities and organizational requirements, ensuring timely and problem-unfastened transactions.

4. Integration with Banking Systems:

The ESIC Employer Login portal seamlessly integrates with banking structures, enabling direct switch of contribution payments from company accounts to ESIC debts. Employers can provoke bills with a few clicks within the portal, decreasing manual intervention and minimizing transactional delays.

5. Contribution Tracking:

ESIC Employer Login provides comprehensive monitoring tools to reveal contribution bills in real-time. Employers can view price statuses, transaction history, and pending contributions inside the portal, facilitating transparency and accountability in financial management.

6. Compliance Reminders:

The portal sends automated reminders and notifications for upcoming contribution cut-off dates, making sure timely compliance with payment duties. Employers get hold of alerts for due dates, overdue fee consequences, and other compliance-related topics, permitting proactive management of contribution schedules.

7. Generating Payment Reports:

ESIC Employer permits employers to generate particular reviews on contribution payments for file-retaining and audit functions. Employers can get entry to charge statements, transaction summaries, and reconciliation reports inside the portal, facilitating documentation and compliance reporting.

Leveraging ESIC Employer Login Welfare

1. Facilitating Access to Healthcare Services:

ESIC presents employees with get right of entry to to nice healthcare services thru its community of hospitals, dispensaries, and clinical facilities. Employers can use the ESIC Employer Login portal to sign up eligible personnel, making sure they’ve seamless get right of entry to to clinical consultations, diagnostic exams, and remedy centers as consistent with ESIC norms.

2. Processing Medical Claims Efficiently:

In the occasion of contamination, harm, or maternity, employees can publish scientific claims through the ESIC gadget. Employers can leverage the ESIC Employer portal to facilitate the processing of scientific claims, making sure well timed compensation of clinical prices and relieving employees of financial burdens in the course of tough instances.

3. Maternity Benefits Management:

ESIC offers comprehensive maternity advantages to woman personnel, which includes paid leave, clinical fees, and coins blessings. Employers can use the ESIC Employer Login portal to manage maternity advantages successfully, ensuring eligible personnel obtain the aid they need all through being pregnant, childbirth, and postnatal care.

4. Disability Support and Rehabilitation:

Employees who be afflicted by work-related accidents or disabilities are entitled to disability benefits and rehabilitation offerings beneath ESIC. Employers can leverage the ESIC Employer Login portal to facilitate the application method for incapacity benefits, making sure affected personnel receive appropriate medical care, monetary assistance, and vocational rehabilitation help.

5. Financial Assistance During Contingencies:

ESIC provides financial help to employees during unforeseen contingencies together with unemployment, sickness, or disablement. Employers can make use of the ESIC Employer portal to tell personnel approximately their entitlements, manual them thru the claims manner, and make sure they obtain well timed help to cope with hard circumstances.

6. Promoting Awareness and Education:

Employers play a essential function in promoting cognizance approximately ESIC blessings and teaching employees approximately their rights and entitlements. Through the ESIC Employer Login portal, employers can disseminate facts, share assets, and conduct education classes to enhance worker knowledge of ESIC schemes and their benefits.

7. Ensuring Compliance with ESIC Regulations:

Compliance with ESIC regulations is essential for employers to fulfill their duties and provide employees with get right of entry to to advantages seamlessly. The ESIC Employer portal facilitates employers live compliant by using facilitating accurate record-retaining, timely contribution bills, and adherence to regulatory necessities, making sure uninterrupted access to worker welfare benefits.

Staying Compliant: ESIC Employer Login Regulations and Updates

1. Real-Time Access to Regulatory Information:

ESIC Employer provides employers with actual-time get entry to to regulatory statistics, including updates, amendments, and circulars issued with the aid of ESIC authorities. Employers can stay knowledgeable approximately changes in contribution costs, eligibility standards, and procedural requirements, ensuring well timed compliance with evolving regulations.

2. Compliance Checklists and Guidelines:

The portal offers comprehensive compliance checklists and pointers to assist employers navigate ESIC rules effectively. Employers can get right of entry to resources consisting of compliance manuals, FAQs, and instructional materials within the ESIC Employer portal, guiding them through regulatory necessities and first-class practices.

3. Contribution Calculation and Payment Reminders:

ESIC Employer Login automates contribution calculation and presents timely reminders for price deadlines. Employers receive indicators for upcoming contribution due dates, overdue price penalties, and different compliance-related subjects, ensuring adherence to contribution necessities and fending off penalties.

4. Record-Keeping and Documentation:

ESIC Employer facilitates accurate report-retaining and documentation of compliance-associated sports. Employers can hold complete records of contribution bills, employee statistics, compliance reviews, and other documentation inside the portal, ensuring readiness for audits and regulatory inspections.

5. Audit Trails and Transaction Logs:

The portal generates audit trails and transaction logs to track changes and sports related to compliance. Employers can reveal consumer moves, assessment transaction history, and analyze audit logs in the ESIC Employer portal, ensuring transparency and responsibility in compliance control.

6. Compliance Reporting and Analysis:

ESIC Employer offers robust reporting and evaluation tools to evaluate compliance fame and discover areas for improvement. Employers can generate compliance reports, examine traits, and song key performance indicators within the portal, allowing information-pushed choice-making and continuous development in compliance control.

7. Integration with Regulatory Portals:

The portal integrates seamlessly with regulatory portals and government databases to facilitate facts exchange and regulatory reporting. Employers can synchronize worker records, post compliance reports, and get entry to regulatory updates directly through the ESIC Login portal, streamlining compliance management methods.

Troubleshooting and Support Resources ESIC Employer Login

1. Help Documentation and FAQs:

ESIC Employer portal gives comprehensive assist documentation and frequently asked questions (FAQs) to address commonplace user queries and troubles. Employers can access these assets within the portal to find solutions to their questions and troubleshoot problems independently.

2. Online Chat Support:

ESIC Employer presents online chat help for real-time help with technical problems and account-related queries. Employers can initiate chat periods with support representatives at once within the portal, permitting brief resolution of issues and clarification of doubts.

3. Email Support:

Employers can reach out to ESIC support group through e-mail for assistance with complex issues or escalation of unresolved queries. ESIC offers dedicated e mail addresses for specific varieties of aid inquiries, ensuring set off and personalized help to employers.

4. Toll-Free Helpline:

ESIC offers a toll-free helpline quantity for employers to are looking for assistance with ESIC Login-associated problems. Employers can call the helpline to connect to customer support representatives who can offer steerage, troubleshoot troubles, and deal with issues over the cellphone.

5. User Forums and Community Groups:

ESIC Employer may additionally have user boards or network businesses where employers can interact with friends, percentage experiences, and seek advice on troubleshooting troubles. Participating in these forums permits employers to gain from collective understanding and peer guide in resolving demanding situations.

6. Training Workshops and Webinars:

ESIC organizes schooling workshops and webinars to educate employers on using the ESIC Employer portal correctly. These periods cowl subjects which includes account setup, navigation, troubleshooting, and nice practices, empowering employers to maximize the software of the portal.

7. On-Site Assistance:

In cases in which employers require on-web page assistance or personalized assist, ESIC may additionally provide on-web site visits or consultations. Trained representatives can visit the employer’s premises to provide fingers-on help, troubleshoot technical troubles, and address unique worries related to ESIC Employer .

8. Knowledge Base and Resources:

ESIC maintains a knowledge base and resource repository containing articles, publications, tutorials, and troubleshooting hints for ESIC Employer users. Employers can get entry to those assets to enhance their knowledge of the portal and troubleshoot issues independently.

Frequently Asked Questions (FAQs)

ESIC Employer Login is an online portal supplied by means of the Employees’ State Insurance Corporation (ESIC) for employers to control their ESIC-related duties, consisting of employee facts control, contribution processing, and compliance monitoring.

To register for ESIC Employer Login, go to the official ESIC internet site and navigate to the Employers phase. Click on the registration link and comply with the activates to offer necessary information about your corporation and create login credentials.

ESIC Employer Login gives capabilities consisting of employee facts control, contribution processing, claim submission, compliance tracking, reporting, and support resources to facilitate green body of workers management and statutory compliance.

Employers can upload personnel to the ESIC portal by logging into their account, navigating to the employee management section, and getting into the desired details for every worker, which includes non-public information and ESIC eligibility standards.

Employers can manner ESIC contributions thru the portal by getting into employee salary details, calculating contribution amounts, and initiating price transactions using the to be had payment alternatives which include on-line transfers or e-fee gateways.

Related posts:

- Jaa Lifestyle Login: Portal, Benefits, Product and Services

- Spice Money Login: Guide, Seamless Experience, App Login

- Hotstar Login: Creating Account, Troubleshooting, Premium vs Free

- Staff Login: Right Authentication, Challenges, SSO, Training

- AWPL Login: Features, Authentication Methods, Troubleshooting

- IFHRMS Login: Organizations, Security, Troubleshooting

- SSO ID Login: Process, Update, Security, Navigating

- Epunjabschool Login: Academic Progress, Registration Process