CTC stands for Cost to Company. It is the total amount of money that a company spends on an employee, including their salary, benefits, taxes, and other associated costs.

Companies use CTC to calculate the overall cost of hiring and retaining employees. It is also used to compare the costs of hiring different employees or groups of employees.

CTC is an important metric for businesses because it can help them to make informed decisions about their staffing levels and compensation packages.

Here are some of the components that are typically included in CTC:

- Salary

- Bonuses

- Allowances

- Medical insurance

- Provident fund

- Gratuity

- Taxes

The specific components of CTC may vary depending on the company and the country in which it is located.

It is important to note that CTC is not the same as net salary. Net salary is the amount of money that an employee receives after all deductions have been made, such as taxes and social security contributions.

CTC is a useful metric for both employers and employees. Employers can use it to budget for their staffing costs and to ensure that they are competitive in the job market. Employees can use it to compare different job offers and to negotiate their salary and benefits packages.

What is the CTC for 18000 salary?

The CTC for a salary of 18000 depends on a number of factors, including the employee’s location, experience, and the company’s policies. However, a typical CTC for a salary of 18000 in India would be around 25000-27000.

This is because CTC typically includes a number of components in addition to base salary, such as:

- House rent allowance (HRA)

- Conveyance allowance

- Medical allowance

- Provident fund (PF)

- Employee State Insurance (ESI)

- Gratuity

The specific components of CTC and their amounts can vary depending on the company, but the above are some of the most common.

Here is an example of how a CTC of 25000-27000 might be broken down:

- Base salary: 18000

- HRA: 4500

- Conveyance allowance: 1500

- Medical allowance: 1000

- PF: 1200

- ESI: 300

- Gratuity: 200

It is important to note that this is just an example, and the actual CTC for a salary of 18000 could vary depending on the factors mentioned above.

If you are offered a job with a salary of 18000, it is important to ask the company about the CTC breakdown so that you can understand all of the components of your compensation package.

How is Cost To Company(CTC) calculated in salary?

The Cost to Company (CTC) is calculated by adding up all of the direct and indirect costs that a company incurs on an employee in a year. This includes the employee’s base salary, as well as any bonuses, allowances, benefits, and taxes that the company pays on behalf of the employee.

Here is a formula for calculating CTC:

CTC = Base Salary + Bonuses + Allowances + Benefits + Taxes

The specific components of CTC and their amounts can vary depending on the company and the country in which it is located. However, some common components of CTC include:

- Base salary

- Bonuses

- Allowances (e.g., housing rent allowance, conveyance allowance, medical allowance)

- Benefits (e.g., health insurance, provident fund, gratuity)

- Taxes (e.g., income tax, employee state insurance)

For example, if an employee has a base salary of ₹18000 per month, and the company pays a 10% bonus, a 15% housing rent allowance, and a 10% conveyance allowance, then the employee’s CTC would be:

CTC = ₹18000 + ₹1800 + ₹2700 + ₹1800 + ₹0 = ₹24300

It is important to note that CTC is not the same as net salary. Net salary is the amount of money that an employee receives after all deductions have been made, such as taxes and social security contributions.

CTC is a useful metric for both employers and employees. Employers can use it to budget for their staffing costs and to ensure that they are competitive in the job market. Employees can use it to compare different job offers and to negotiate their salary and benefits packages

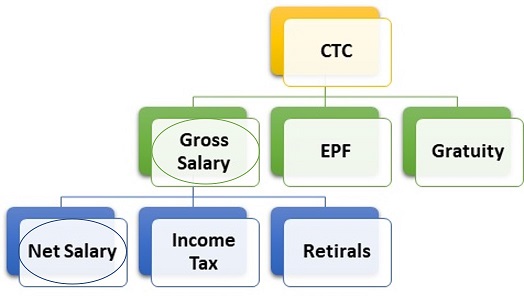

What is the difference between gross salary and CTC?

The main difference between gross salary and CTC is that CTC includes all of the costs that a company incurs on an employee, while gross salary does not.

CTC (Cost to Company) is the total amount of money that a company spends on an employee in a year. This includes the employee’s base salary, as well as any bonuses, allowances, benefits, and taxes that the company pays on behalf of the employee.

Gross salary is the employee’s base salary, plus any bonuses or allowances that they receive. It does not include any benefits or taxes that the company pays on behalf of the employee.

It is important to note that CTC is not the same as net salary. Net salary is the amount of money that an employee receives after all deductions have been made, such as taxes and social security contributions.

Here is an example to illustrate the difference between gross salary and CTC:

- Base salary: ₹18000

- Bonuses: ₹1800

- Allowances: ₹2700

- Benefits: ₹3000

- Taxes: ₹0

Gross salary: ₹18000 + ₹1800 + ₹2700 = ₹22500 CTC: ₹18000 + ₹1800 + ₹2700 + ₹3000 + ₹0 = ₹25500

As you can see, the CTC is ₹3000 higher than the gross salary. This is because the CTC includes the cost of the employee’s benefits, which are not included in the gross salary.

CTC is a useful metric for both employers and employees. Employers can use it to budget for their staffing costs and to ensure that they are competitive in the job market. Employees can use it to compare different job offers and to negotiate their salary and benefits packages.

What benefits are included in CTC (Cost To Company)?

- Health insurance: This covers the cost of medical expenses for the employee and their dependents.

- Provident fund (PF): This is a retirement savings plan that is contributed to by both the employee and the employer.

- Gratuity: This is a lump-sum payment that is paid to the employee upon retirement or resignation after a certain number of years of service.

- Leave: Most companies offer employees paid leave for vacation, sick days, and personal days.

- Bonuses and incentives: Many companies offer employees bonuses and incentives for meeting certain goals or objectives.

- Other benefits: Some companies may also offer other benefits such as tuition reimbursement, transportation assistance, and child care assistance.

It is important to note that CTC is not the same as net salary. Net salary is the amount of money that an employee receives after all deductions have been made, such as taxes and social security contributions.

CTC is a useful metric for both employers and employees. Employers can use it to budget for their staffing costs and to ensure that they are competitive in the job market. Employees can use it to compare different job offers and to negotiate their salary and benefits packages.

Gross and Net Salary Calculation from CTC

Gross salary is the employee’s base salary, plus any bonuses or allowances that they receive. It does not include any benefits or taxes that the company pays on behalf of the employee.

Net salary is the amount of money that an employee receives after all deductions have been made, such as taxes and social security contributions.

To calculate gross salary from CTC, you can use the following formula:

Gross salary = CTC - (benefits + taxes)

To calculate net salary from CTC, you can use the following formula:

Net salary = Gross salary - taxes

Here is an example to illustrate how to calculate gross and net salary from CTC:

- CTC: ₹25500

- Benefits: ₹3000

- Taxes: ₹2500

Gross salary: ₹25500 – ₹3000 = ₹22500 Net salary: ₹22500 – ₹2500 = ₹20000

It is important to note that the specific benefits and taxes that are included in CTC can vary depending on the company and the country in which it is located. Therefore, it is always best to consult with your employer to get an accurate calculation of your gross and net salary.

Here are some tips for maximizing your net salary:

- Negotiate your salary and benefits package: When you are negotiating a job offer, be sure to ask about the CTC and the breakdown of benefits. You may be able to negotiate a higher salary or a better benefits package.

- Take advantage of tax-advantaged savings plans: There are a number of tax-advantaged savings plans available, such as 401(k) plans and IRAs. These plans can help you to save money for retirement and reduce your taxable income.

- Claim all of your eligible tax deductions and credits: When you file your taxes, be sure to claim all of the eligible deductions and credits that you are entitled to. This can help to reduce your tax liability and increase your net salary.

By following these tips, you can maximize your net salary and save more money